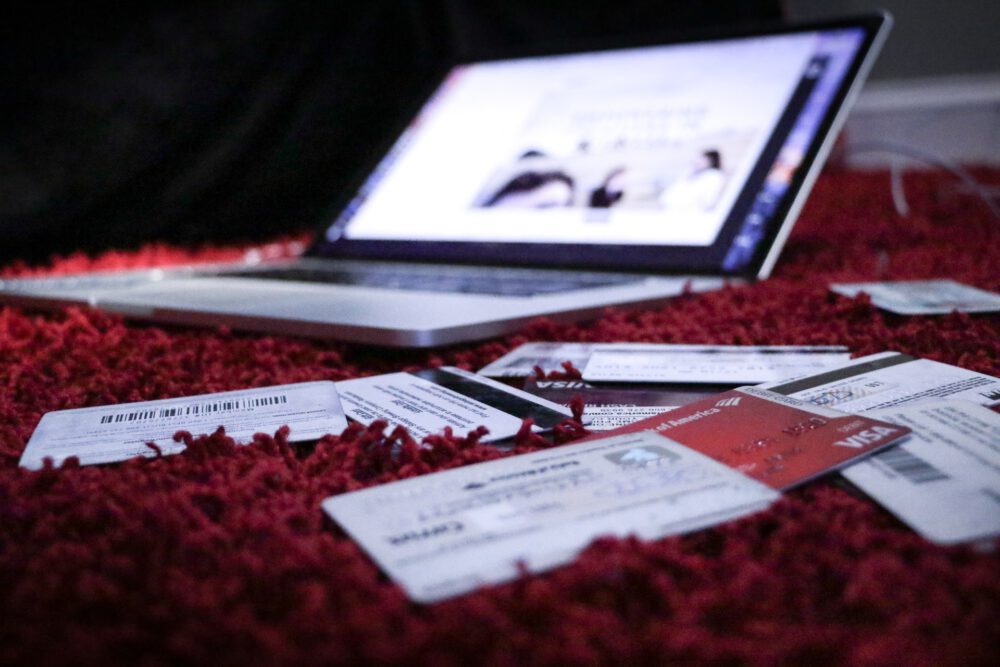

A credit repair business is a great way to earn money while helping others boost their credit scores. However, starting a business of this nature isn’t as simple as it sounds. You’ll need to be diligent about following the law, marketing your services, and using effective methods to secure clients.

The best way to get started on a credit repair business is by getting yourself familiar with the industry. Depending on your location, you may need to obtain the proper permits and licenses. Additionally, you’ll need to establish a business bank account so you can track your income easier. There are several options for financing your new business, including loans from a bank and friends and family.

To get the most out of your investment, you’ll need a website to showcase your skills and services. Your website should offer valuable information and be easy to navigate. If possible, it should be a customer-facing site, which will help establish your credibility as a professional in the field.

You may also wish to consider marketing your services to people who have recently been turned down for a loan. This is a good strategy because customers will be more likely to choose your business over other options.

Another smart move is to use a service that can automatically detect and remove negative items from a client’s credit report. Some software solutions like DisputeBee can be extremely useful in this regard. Its platform is available both to individuals and professional credit repair companies.

Other ways to build your business include affiliate marketing. Many companies will pay you to promote their products or services. For example, a local realtor might be willing to pay you to refer prospective clients to a company that offers this service.

Another smart idea is to utilize a professional web designer to design a sleek and functional website. They’ll be able to do everything from setting up your client billing to creating an attractive and functional web presence. In addition, they’ll be able to assist with invoicing.

Another great idea is to use an online crowdfunding website. Crowdfunding sites allow you to solicit funds from multiple investors to help you achieve your vision. One such website, Kickstarter, is a great option because it is relatively low risk.

Starting your own credit repair business doesn’t have to be difficult, but it does require some hard work. However, it is a worthwhile venture that can be highly profitable. Remember, the most important aspect of a successful business is being a good provider of high quality services. Start with a short business plan, which includes the basics, such as how you will market your business, how you will charge your clients, and how you will manage your expenses.

Finally, you’ll want to do a little research on the laws and regulations in your state. Whether you’re planning to set up shop in your own home, rent an office, or move your business to another state, it’s a good idea to check on local requirements before putting in the effort.